Get In Touch

There's a world of Data Insight Opportunity just for you

Harness the power of cultural intelligence to win diverse America. Discover how you can turn insights into impact today!

Connect with your diverse consumers to accelerate brand growth using Collage Group’s comprehensive, culture-driven consumer research, deep insights, and strategic expertise. Discover how you can turn insights into impact, not just over time, but today.

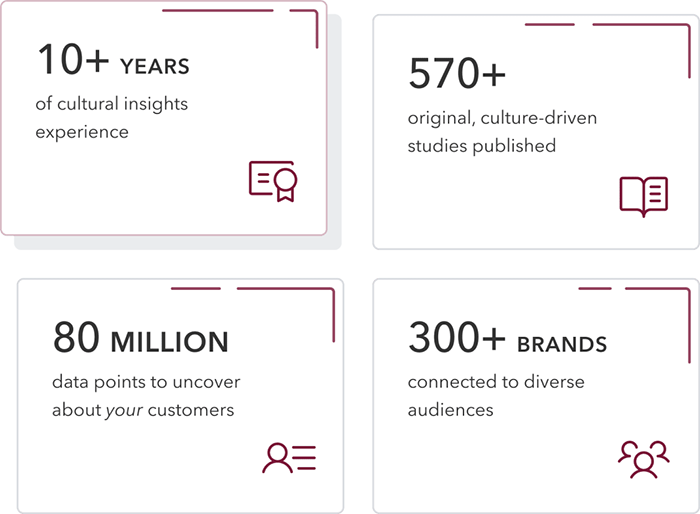

Leading brands today realize that the new American mainstream is changing and becoming increasingly diverse. Companies like American Express and Coca-Cola power their growth through cultural fluency, the ability to use culture to connect efficiently and effectively across diverse consumer segments.

Our solutions and expertise will help you make cultural fluency part of your brand’s DNA, so you can become culturally resonant and achieve your growth goals.

Take action on culture-driven consumer research curated into ready-to-consume insights. Make strategic decisions and create messaging that engages unique audiences across race and ethnicity, generation, gender and sexual identity.

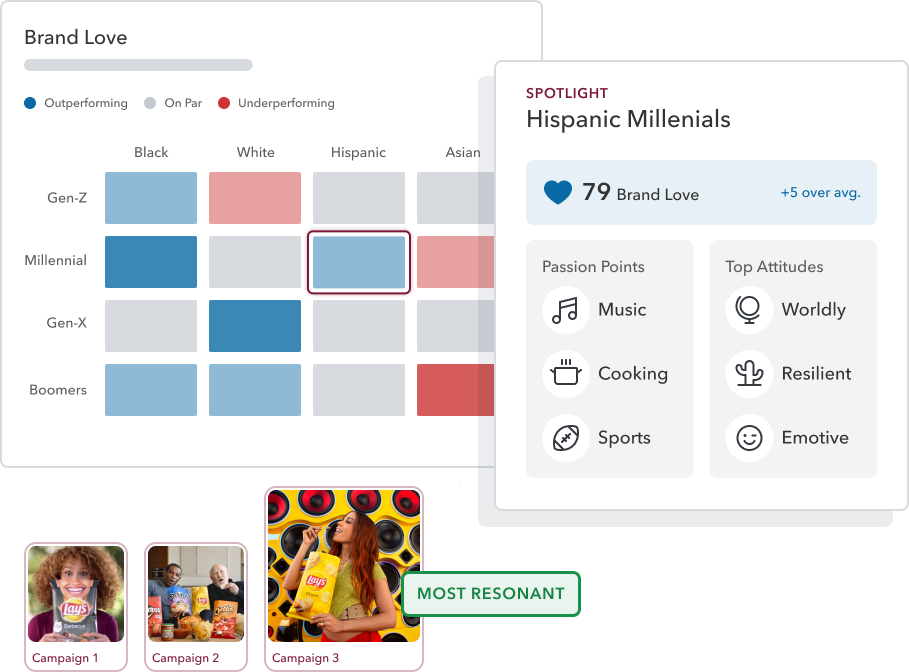

Uncover unique brand-specific cultural insights to enhance campaigns and get a competitive edge. Layer demographic data points over psychographic traits, category-specific media consumption, shopping habits, and brand affinity.

Engage our cultural insights and strategy experts to delve deeper into audience, category, and brand insights. From audience development to custom research, we’ll help you strategize and create the most impactful campaigns.

Transform your marketing and brand strategy with the most comprehensive cultural intelligence insights on the market. Start your journey to cultural fluency with Collage Group.

Make data-driven decisions from day one of working with our insights. Optimize campaigns in flight or plan for your next big initiative.

Identify opportunities to improve your campaigns, reduce media waste, and validate the impact of your efforts.

Inform your brand, marketing, and advertising strategies with data that is constantly updated to reflect the shifting mindsets of diverse American consumers. Never again worry about sounding out of touch or missing a trend.

Understand your consumers like never before and make them feel seen, heard, and represented.

Drive awareness and love for your brand. Shape your brand image and messaging with culture-driven insights fused with brand-specific consumer intelligence.

Take your brand intelligence to the next level. Analyze perceptions of brands—yours, competitors, or partners—across diverse target audiences, like Black Gen Zs, LGBTQ+ Parents, or Hispanic Small Business Owners.

Tap into the collective knowledge of our team of cultural, marketing/advertising, and industry experts.

Work with our team to continuously refine your strategy and improve your brand’s reputation.

Count on us to ask the hard questions about the profound impact of culture and diversity in America. Unlike other consumer research companies, we are not afraid to uncover the objective truth in our research and insights.

"Collage has been a strategic partner in guiding our multicultural strategy, both through our membership and custom work. Their consumer insights & data have helped the work of our diverse segments team immensely. I recommend Collage Group to any brand serious about understanding and winning [multicultural audiences]."

Nelson Siu

VP, Brand & Enterprise Marketing Strategy

“We are better marketers and insights people because of the insightful and actionable suite of research tools and resources developed by you and your team, and the thought leadership and partnership of each and everyone of you. Thanks so much for joining our panel and sharing your perspective. The feedback has been phenomenal!”

Kathy Dini James

Insights Lead

“Collage is and has been a great partner for Welch’s. Collage’s data and insights is one of our most valuable resources.”

Kelly Coyne

Head of Consumer and Market Insights

Harness the power of cultural intelligence to win diverse America. Discover how you can turn insights into impact today!

Stay Informed

Email *:

MARKET RESEARCH

SOLUTIONS

fluen.ci App for Cultural Insights

Consumer Research Data & Tools

RESOURCES

Webinar & Events

ABOUT

Who We Are

Collage Group is a certified Minority Business Enterprise (MBE) by the National Minority Supplier Development Council (NMSDC).

©2023 Collage Group

4550 Montgomery Avenue

Bethesda, Maryland, 20814

(240) 482-8260

Stay Informed

Email *:

Collage Group is a certified Minority Business Enterprise (MBE) by the National Minority Supplier Development Council (NMSDC).

©2023 Collage Group