We’re sorry. The page you are looking for appears to be missing.

The page that you are looking for does not exist. You may have accidentally mistyped the page address, or followed an expired link. Let us help you get back on track!

The page that you are looking for does not exist. You may have accidentally mistyped the page address, or followed an expired link. Let us help you get back on track!

Explore how Millennial Parents are transforming back-to-school shopping with early starts, hybrid browsing, and family-driven purchase decisions

Younger consumers seek relatable influencers over big names. Discover how trust, identity, and cultural relevance drive loyalty in today’s social landscape.

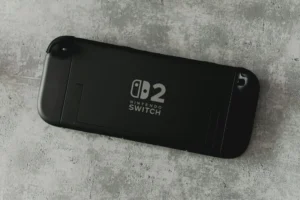

Nintendo’s Switch 2 unlocks cross-industry brand opportunities by tapping into gaming’s cultural power across generations.

Discover how multicultural and Gen Z consumers are shaping trends in AI, finance, wellness, and media in the evolving 2025 U.S. market.