DTC CPG Insights: Direct-To-Consumer Insights for Personal Care CPG Providers

Our research examines the DTC market across race and ethnicity to help CPG providers better understand consumer demand in this growing space. We look at whether CPG brands should incorporate DTC as an additional pathway to reaching consumers, as well as the ongoing role of third-party sellers and intermediaries in today’s environment.

Fill out the form for an excerpt from our Personal Care Consumer Insights presentation.

Scroll down to learn more about Collage Group’s DTC CPG Insights, or click on the subheadings below to jump to a given section.

- There’s a strong need for both in-store and online points of sale

- The majority of Americans still shop at big box stores despite DTC market growth

- There’s consumer demand for subscription-based services offering personal care items

What does DTC mean in business?

The U.S. online direct-to-consumer market has grown from $76.57 billion in 2019 to $155.69 billion in 2022. Research indicates the top drivers for this growth include:

- Lower business costs;

- A chance to attain higher profit margins;

- The capability to provide an improved customer experience;

- The capacity to personalize service offerings;

- Enhanced control and accuracy over customer data;

- Minimal barriers to entry.

In addition to these advantages, consumer insight data has revealed a preference for online shopping, which is an onramp for DTC brands. For instance, a survey by Mckinsey and Company indicates that nearly one in four U.S. households already shop for food and beverage items online.

Given the benefits and consumer demand for DTC, numerous CPG companies are actively exploring opportunities to directly connect with consumers through digital DTC channels. To enter the DTC landscape, some CPG manufacturers are strategically acquiring rapidly growing startups that are seemingly disrupting the market with their DTC product lines. For example, Unilever acquired Dollar Shave Club, while Campbell’s Soup made a $10 million investment in the meal-kit company Chef’d. These moves demonstrate how CPG companies are venturing into the DTC realm to leverage its potential.

At Collage Group we’ve explored this DTC trend further, focusing on where and how consumers prefer to purchase their personal care products. We’ve deliberately focused on personal care products even though the DTC market has seen significant growth in various sectors, including food, clothing, and sports equipment. CPG is a relatively new entrant to DTC, but an important one to focus on, given it’s unique value in consumers’ lives.

There’s a strong need for both in-store and online points of sale

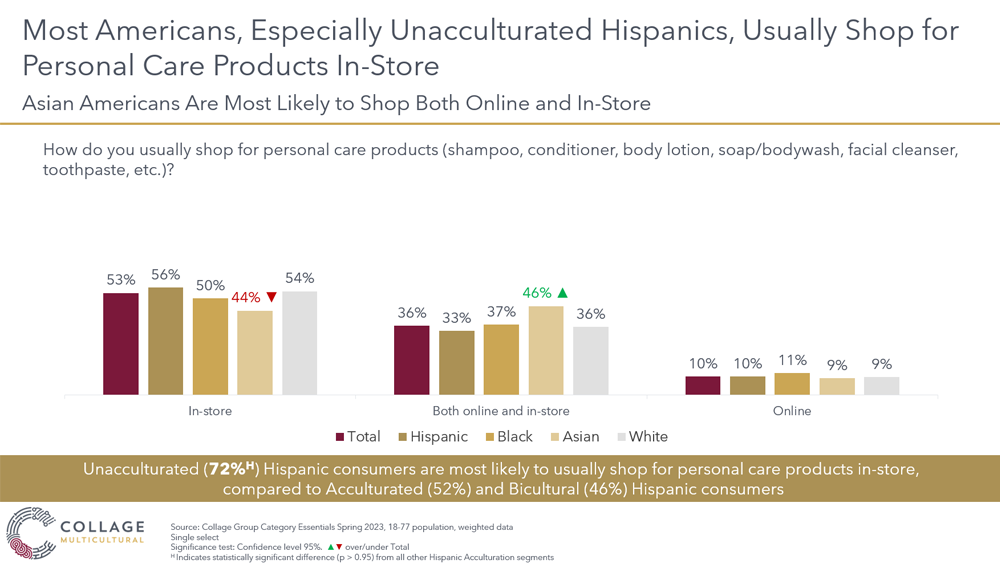

While in-store shopping is popular for most consumers when buying personal care products (53%), many Americans toggle between both in-store and online, and a solid 1 in 10 only shop online for personal care. This is most prevalent in Asian communities who predominantly bought personal care items both online and in-store combined (46%). These results highlight the importance of offering a comprehensive range of purchasing avenues, encompassing both brick-and-mortar retail and online platforms.

The majority of Americans still shop at big box stores despite DTC market growth

With the above results in mind, we take a closer look at where consumers are making in-store and online purchases.

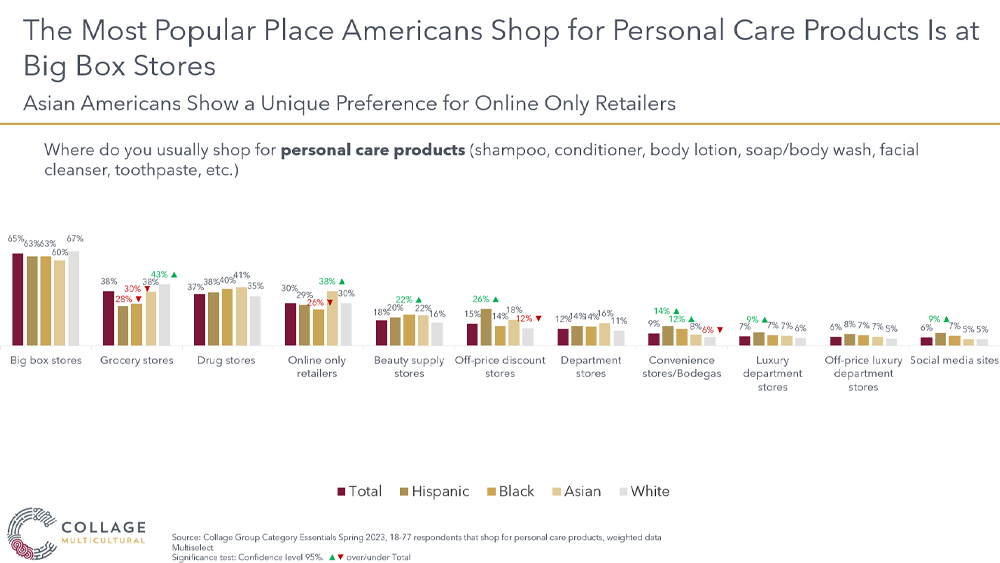

Despite the recorded rise in consumer preference for DTC brands, recent research by Collage Group has found that the majority of U.S. consumers mostly purchase personal care products from big box stores. This would include brands such as Walmart, Target, and Costco. These results are true across race and ethnicity, including Hispanic (63%), Black (63%), Asian (60%), and White (67%) communities.

Online-only retailers, which would include behemoths like Amazon as well as growing DTC options such as e-commerce brands, were shown to be the fourth most used means of purchasing personal care products across the total U.S. population, although there’s some variance due to race and ethnicity. That is, for Asian populations, online retailers were the third most used means of purchasing personal care products. 38% of respondents from Asian populations bought personal care items online compared to the 30% average across race and ethnicity. This suggests online DTC e-commerce brands selling personal care products would be most successful in targeting Asian consumers.

Social media sites were identified as the least favored point of sale among consumers, true across Black (7%), Asian (5%), and White populations (5%). Again, there was some slight race and ethnic variation with Hispanic populations favoring social media sites over off-price luxury department stores. Nevertheless, this information indicates that although social media is an effective marketing medium, sites won’t be effective at driving DTC sales of personal care products.

There’s consumer demand for subscription-based services offering personal care items

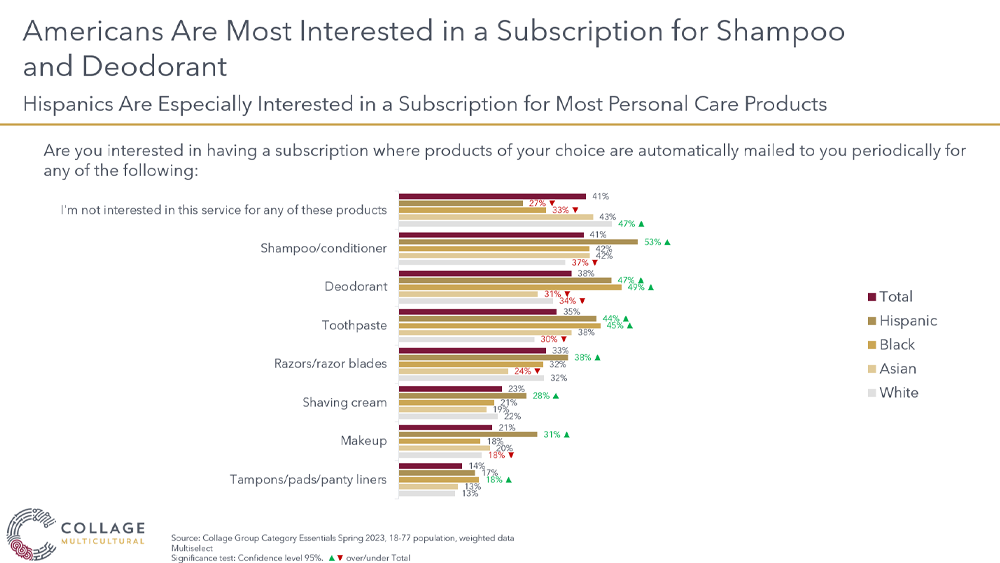

Yet even though U.S. shoppers chiefly visit big box stores to purchase personal care items, Hispanic and Black consumers show a strong inclination for DTC through a subscription-based model.

In fact, most Black and Hispanic populations said they were interested in a subscription service for personal care items we asked about in our research. This insight presents an opportunity for CPG brands to better align their offering with the interests of Black and Hispanic consumers in particular. That is, brands could expand their product portfolio to include subscription-based services, selling certain product lines directly to the consumer to meet this need in Hispanic and Black populations.

And this is an opportunity that hasn’t gone unnoticed. For instance, the industry giant Unilever evolved their product portfolio to meet a consumer desire for subscription-based services via the acquisition of the Dollar Shave Club. The Dollar Shave Club offers a DTC experience delivering razors via a subscription model. In 2016 Unilever acquired the brand with $1 billion in cash.

Looking specifically at the different personal care product categories, the preference for a subscription-based service was strongest for shampoo/conditioner and deodorant categories across race and ethnicity. Interestingly, only a small percentage of respondents noted a preference for a subscription-based service for razors and razor blades (33% across race and ethnicity). Despite this lower percentage, the success of the Dollar Shave club demonstrates the opportunity available in meeting the needs of even a small market segment.

Likewise, the subscription-based DTC brand Lola – which provides a customized tampon delivery service – closed on $24 million in series B funding in 2018. Our research indicates only a small percentage of the U.S. population (14%) is interested in having a subscription where tampons, pads, and panty liners are mail delivered. Yet, that 14% still represents an opportunity to meet a consumer need, one on which Lola has capitalized.

CPG brands should adopt a DTC model alongside third-party sales for personal care items

Based on our research findings, we can conclude that consumer demand for big box stores, such as wholesalers and large retailers, remains significant in the market for personal care items. Despite the growth of the DTC market, it’s unlikely that the DTC model will fully replace the need for consumer goods companies to engage with third-party sellers.

However, there’s a noticeable demand for DTC options, particularly through subscription-based services. Implementing a DTC model presents a readily available opportunity for CPG brands to capitalize on and better cater to the diverse needs of their customer base. Some prominent players in the CPG industry have already recognized this potential and have taken strategic steps to leverage it.

It should be noted that our conclusions are specific to the personal care product industry only. Expanding our research to include various CPG product lines would provide broader insights into the DTC landscape within the CPG industry.

This blog includes a small sample of the deep cultural intelligence available to our members. Contact us to learn how you can unlock full access to our Cultural Intelligence Engine.