From Coins to Confidence: What Crypto Tells Us About Consumers’ Financial Outlook

As economic uncertainty continues to shape household decision-making, one trend is quietly signaling a deeper shift in how Americans—especially Multicultural and younger segments—think about money, trust, and financial confidence. Crypto is no longer just a speculative asset. It has become a cultural cue, revealing how consumers evaluate emerging tools, question traditional systems, and search for greater control in their financial futures.

At Collage Group, our latest consumer insights show that curiosity toward digital financial products is growing even as headlines about crypto volatility dominate the news. What’s driving this tension? And what does it mean for brands competing in an environment where expectations for autonomy, transparency, and digital fluency are expanding?

A window into consumer trust and control

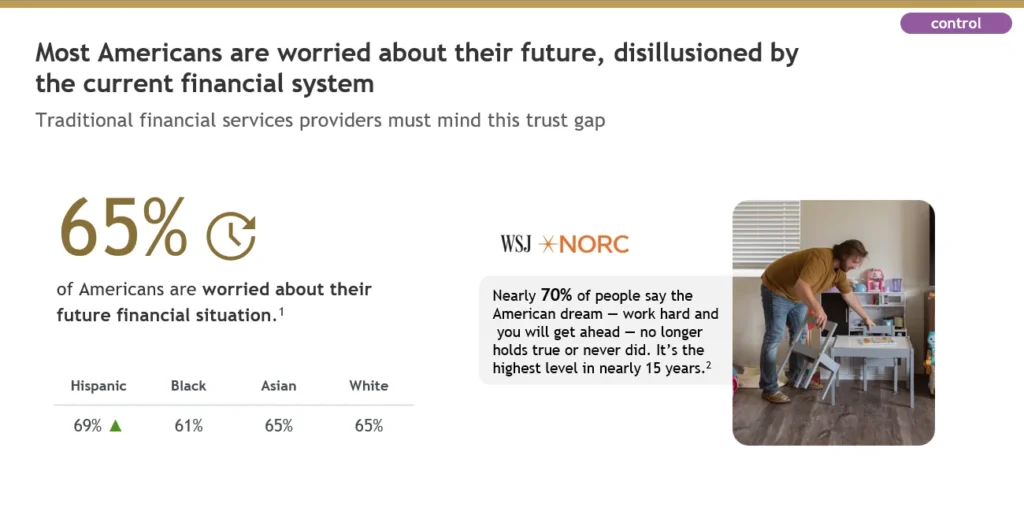

Many Americans—especially Hispanic, Black, and Asian consumers—are reassessing where they place their financial confidence. Their interest in crypto isn’t simply about returns. It reflects a broader desire for tools that feel more transparent, more accessible, and more personally empowering than traditional financial systems.

This mindset shift matters. When consumers look for self-direction and clarity in their financial decisions, they gravitate toward brands that help them feel informed and in control. That dynamic is especially strong among Multicultural consumer segments whose financial experiences, needs, and expectations often diverge from the general population.

Digital habits are reshaping financial expectations

Digital payment apps and financial platforms are helping to normalize alternative financial behaviors—sometimes serving as the first point of entry for consumers exploring more emerging products. For many, crypto represents the next step along that continuum: a symbol of modern financial identity rather than a narrow investment vehicle.

Multicultural consumers, in particular, are more likely to integrate digital tools into their daily financial lives. This reinforces a larger story about convenience, trust, and cultural relevance—one that has meaningful implications for financial services brands trying to keep pace with fast-changing behaviors.

Why this trend matters for growth-focused brands

Crypto itself may or may not be part of your roadmap. But the attitudes surrounding it are powerful indicators of consumer expectations—especially among segments that over-index on youthfulness, cultural influence, and population growth.

Brands that understand these mindset shifts will be better positioned to build financial confidence, strengthen loyalty, and design products that feel aligned with how today’s consumers define progress. The takeaway isn’t about crypto adoption; it’s about recognizing the broader movement toward autonomy, flexibility, and culturally attuned financial solutions.

Our new report unpacks these signals in detail—revealing how consumer trust is evolving, why digital curiosity is accelerating, and what financial services brands must understand to stay relevant with diverse, high-growth audiences.

Ready to explore the full set of insights shaping the future of financial confidence?

Download the excerpt of From Coins to Confidence to see the findings that matter most for your growth strategy.